Card Services

VISA Card

Who is eligible to get VISA card

- A Savings Account holder with authority to operate the account in individual capacity.

- Current Account holder (only for a Current Account in individual name or proprietorship)

Features of the product

- Withdraw up to 15,000.00 Birr per day per card subject to the balance in your account.

- Purchase goods or services up to Birr 200,000.00 per day per card at any of the Dashen Bank merchants.

Benefit of using VISA Card

- Access your money 24 X 7 X 365, without limitation for bank working hours.

- Operate multiple accounts with a single card.

- Check the balances of all accounts linked to the card.

- Obtain mini-statement that lists the last ten transactions in any of your accounts linked to your card.

What should you do if you lost your card

- Since you have your own Personal Identification Number (PIN), the risk of your card being used by other person is minimized. However, you need to report to the Dashen contact center agents immediately so that the card would be blocked.

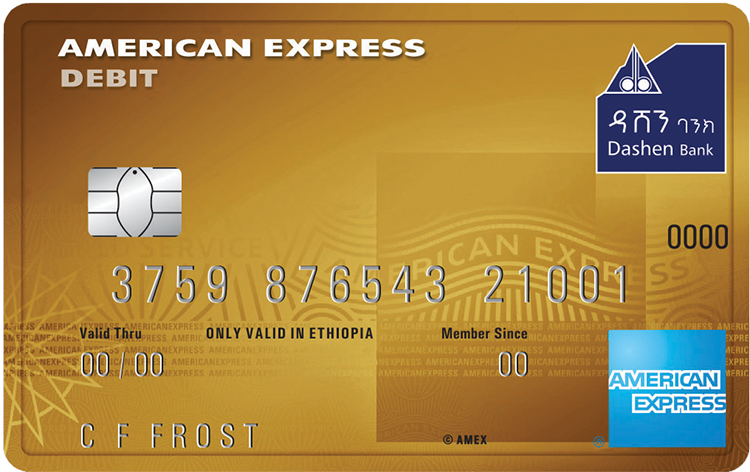

Dashen American Express Gold Debit Card

Dashen American Express Gold Debit Card

The Dashen American Express Gold Debit Card allows you to enjoy special daily transaction limits. In addition, you can make cash withdrawals at Dashen Area Banks as well as ATM locations.

- Special daily transaction limits of up to ETB 500,000.00 per day at merchant locations.

- Withdraw cash of up to ETB 50,000.00 per day at Branch POS machines.

- Withdraw cash of up to ETB 30,000.00 per day at ATM locations

- Enjoy special offers and discounts at selected merchants locally when paying with your Dashen American Express Gold Debit Card

To save time before you apply for your Gold Card, it’s best to make sure you can say yes to the following:

- I have a Dashen Bank current account

- I am 18 years or older

Dashen American Express Green Debit Card

Dashen American Express Green Debit Card

The Dashen American Express Green Debit Card allows you to enjoy special daily transaction limits. In addition, you can make cash withdrawals at Dashen Area Banks as well as ATM locations.

- Special daily transaction limits of up to ETB 300,000.00 per day at merchant locations

- Withdraw cash of up to ETB 50,000.00 per day at Branch POS machines.

- Withdraw cash of up to ETB 20,000.00 per day at ATM locations

- Enjoy special offers and discounts at selected merchants locally when paying with your Dashen American Express Green Debit Card

Eligibility

To save time before you apply for your Green Card, it’s best to make sure you can say yes to the following:

- I have a Dashen Bank current account

- I am 18 years or older

What should you do if you lost your card

- Since you have your own Personal Identification Number (PIN), the risk of your card being used by other person is minimized. However, you need to report to the Dashen contact center agents immediately so that the card would be blocked. The contact service agents can be reached using the address below:

+251 115 18 0007 | +251 115 18 0008 | +251 115 18 0009

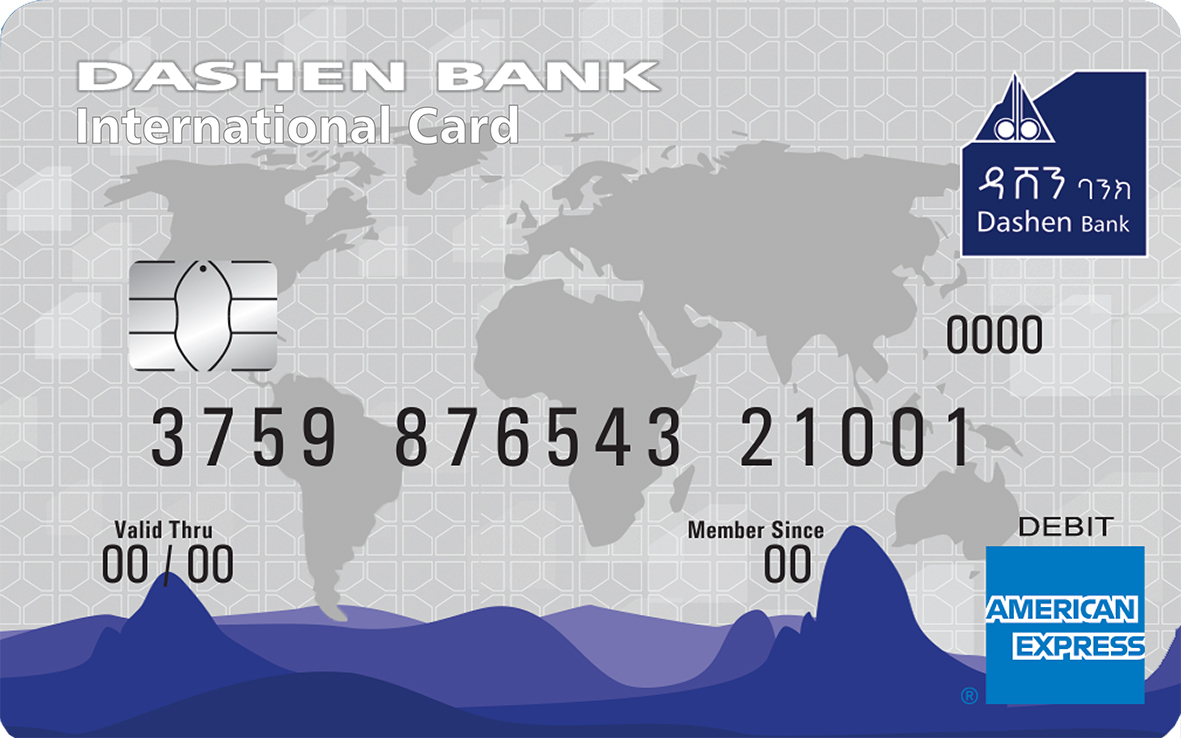

Dashen Amex International Debit Card

International debit card is intended to be given for existing foreign currency account holders of Dashen Bank. Customers should have a foreign currency account maintained at Dashen Bank to be eligible to get the card. Dashen American Express International Debit Card eliminates a need of carrying paper money. One can make transactions in any other currencies in accordance with the exchange rate of the foreign country. Money automatically gets debited from the account linked to the card. Customers can withdraw cash from abroad ATM machines as well as pay for their purchases and bookings on POS machines. customers can be able to withdraw up to 10% of their foreign currency account balance. The card has a maximum of 2 years of expiry date.

Customers can get the card from all of our branches. Since the card is debit card, the balance stays in the account and transactions made with the debit card are set not to exceed 10% of the balance. Customers can request for a replacement if the card is lost or stolen. Customers can also request for PIN replacement if they forget their PIN. The card is planned to be produced into two ways, one from Instant card issuing branches within few minutes and the other from central card producing unit.

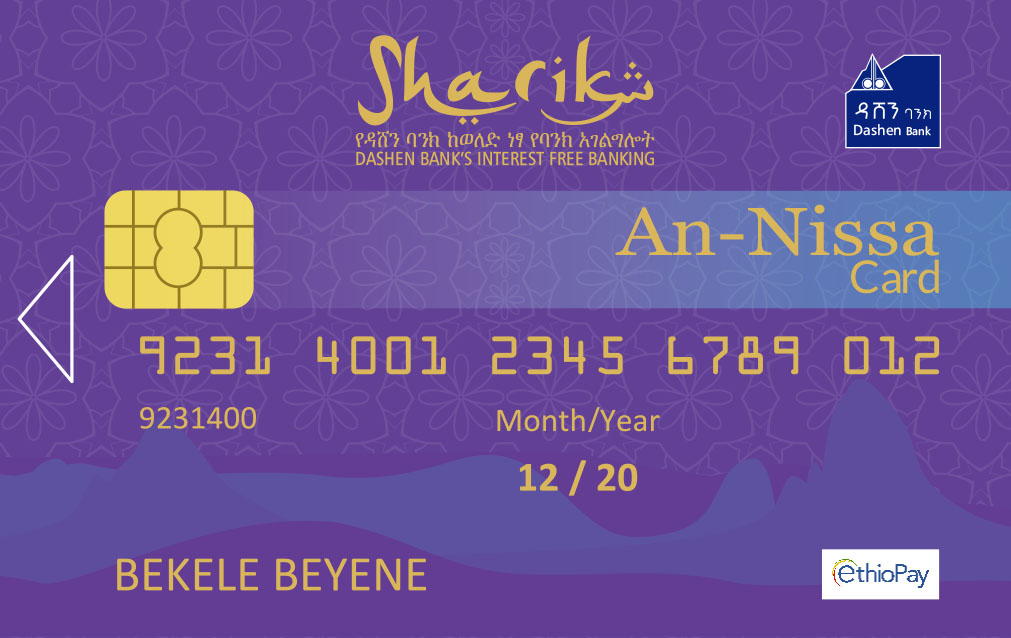

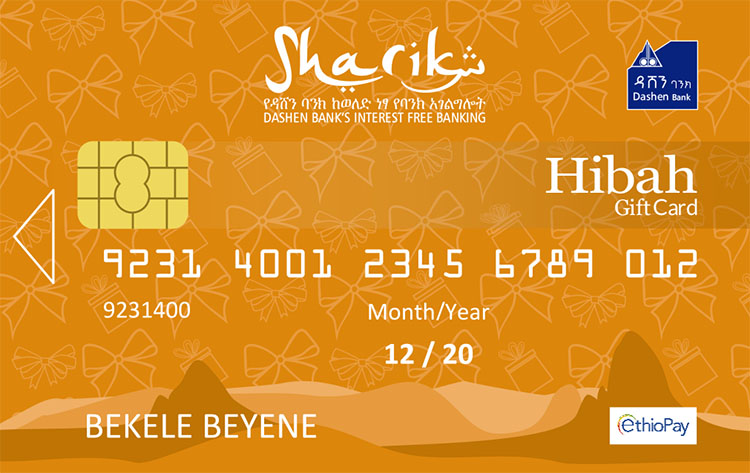

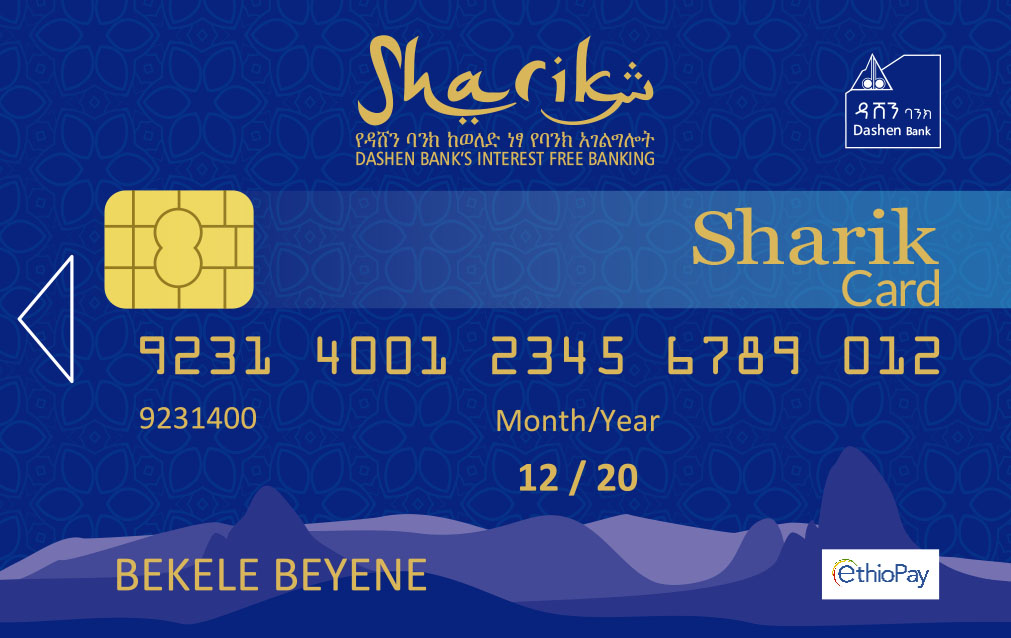

Sharik Cards (IFB cards)

Sharik Cards (IFB cards)

Who is eligible to get Sharik cards

- A Savings Account holder with authority to operate the account in individual capacity.

- Current Account holder (only for a Current Account in individual name or proprietorship)

Features of the product

- Withdraw up to 10,000.00 Birr per day per card subject to the balance in your account.

- Purchase goods or services up to Birr 8,000.00 per day per card at any of the Dashen Bank merchants.

Benefit of using Sharik Cards

Benefit of using Sharik Cards

- Access your money 24 X 7 X 365, without limitation for bank working hours.

- Operate multiple accounts with a single card.

- Check the balances of all accounts linked to the card.

- Obtain mini-statement that lists the last ten transactions in any of your accounts linked to your card.

What should you do if you lost your card

What should you do if you lost your card

- Since you have your own Personal Identification Number (PIN), the risk of your card being used by other person is minimized. However, you need to report to the Dashen contact center agents immediately so that the card would be blocked. The contact service agents can be reached using the address below:

+251 115 18 0007 | +251 115 18 0008 | +251 115 18 0009

Card Acquiring

The Bank accepts the following international cards into its ATMs and POS:

Dashen American Express Gold Debit Card

Dashen American Express Gold Debit Card Dashen American Express Green Debit Card

Dashen American Express Green Debit Card

Sharik Cards (IFB cards)

Sharik Cards (IFB cards)