Dashen Bank netted birr 6.4 billion profit

Dashen Bank netted birr 6.4 billion profit

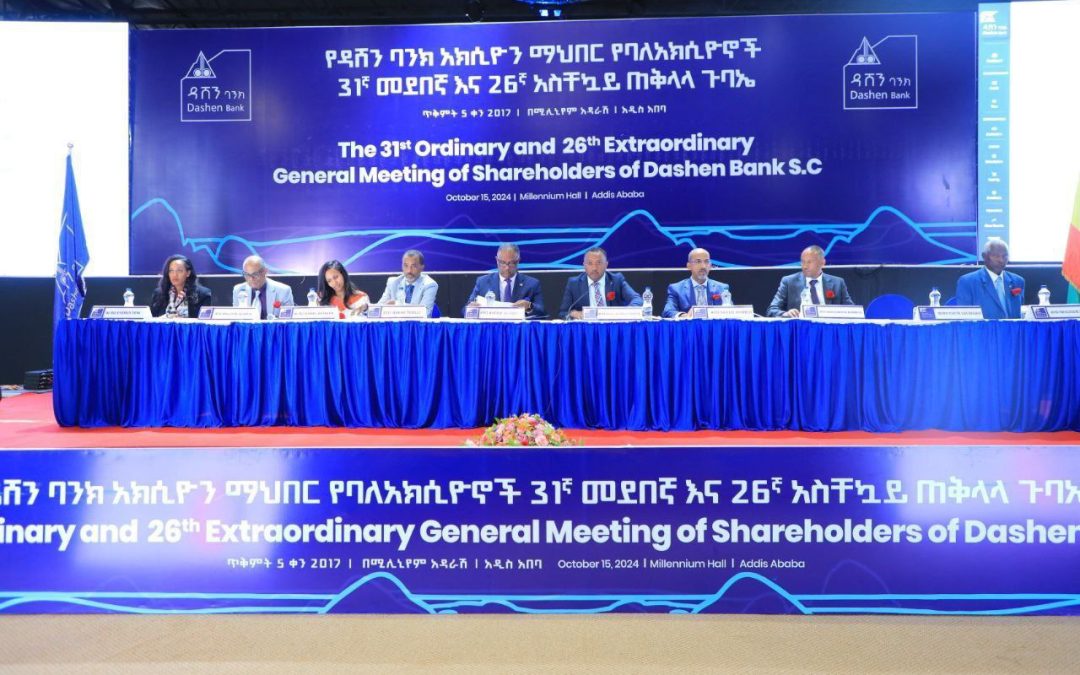

(Addis Ababa, October 15, 2024) – Shareholders of Dashen Bank, one of Ethiopia’s pioneering private banks, gathered today at Millennium Hall for the 31st ordinary and 26th extraordinary annual meetings to review the bank’s performance during the last fiscal year and set out strategic objectives for the coming year.

(Addis Ababa, October 15, 2024) – Shareholders of Dashen Bank, one of Ethiopia’s pioneering private banks, gathered today at Millennium Hall for the 31st ordinary and 26th extraordinary annual meetings to review the bank’s performance during the last fiscal year and set out strategic objectives for the coming year.

Addressing the assembly, Dashen Bank’s Board Chairman, Dula Mekonnen, noted that the past fiscal year had been marked by both global and domestic challenges, which impacted the banking industry while also presenting new opportunities.

On the global stage, Dula highlighted the effects of ongoing geopolitical tensions, including the Russia-Ukraine war and attacks in the Red Sea region, which caused inflationary pressures, price spikes, and supply chain disruptions. Domestically, inflation was further exacerbated by internal conflicts, foreign currency shortages, and disruptions in global trade.

Dula also pointed out that the National Bank of Ethiopia (NBE) had implemented a tight monetary policy at the start of the year, with the goal of curbing inflation. The NBE capped credit growth at 14% and raised the emergency lending rate to banks from 16% to 18%. During the year, Dashen Bank successfully navigated liquidity challenges and a forex crunch while maintaining its commitment to its customers.

He added that competition within the banking industry had increased, particularly with the rise of mobile money platforms. The state-owned Ethio Telecom, through its Telebirr app, and Safaricom’s M-PESA, had redefined customer expectations in financial services.

Despite these challenges, Dashen Bank recorded a highly successful year. The bank achieved a remarkable Birr 30.9 billion growth in deposits, bringing total deposits to Birr 145.9 billion, reflecting a 26.9% year-on-year increase. The Islamic Financial Banking (IFB) division also performed strongly, contributing Birr 11.1 billion in deposits, a 37.2% increase from the previous year.

Dashen Bank’s total assets surged to Birr 183.7 billion, a 27% growth, and the bank concluded the fiscal year with a Birr 6.4 billion profit before tax, representing a 26.8% increase compared to the previous year. The number of new accounts opened during the period exceeded 1.44 million, bringing the total number of accounts to 6.7 million.

Dashen Bank CEO Asfaw Alemu emphasized that the bank had successfully navigated a challenging environment characterized by political, economic, and competitive pressures. Despite these challenges, the bank made significant strides, particularly in digital banking and partnerships with global financial institutions.

He noted that Dashen Bank had partnered with leading global players such as Accion and local fintech companies like EagleLion System Technology to scale up its digital financial solutions. These collaborations aim to enhance the bank’s digital capabilities, enabling the launch of innovative financial products for its customers.

A landmark achievement for Dashen Bank during the fiscal year was securing USD 40 million in funding from British International Investment (BII) and the Dutch Entrepreneurial Development Bank (FMO). The bank also received a USD 40 million trade finance transaction guarantee facility from the African Development Bank (AfDB) to support small and medium-sized enterprises (SMEs) and local businesses engaged in import-export activities.

As part of its commitment to environmental, social, and governance (ESG) initiatives, Dashen Bank has taken steps to establish an ESG policy and department, and is engaging with international partners to build capacity for sustainable initiatives.

Dashen Bank’s prudent management and innovative practices were recognized with several prestigious awards during the fiscal year, including:

“Bank of the Year 2023” for Ethiopia by The Banker magazine, a publication of the UK’s Financial Times.

“Outstanding Global Trade Finance Program Issuing Bank” by the International Finance Corporation (IFC), a member of the World Bank Group.

“Best Bank in the Micro-Lending Category” by Pan Africa Bank 4.0, in recognition of the bank’s digital financial innovations.

As Dashen Bank continues to grow and evolve, it remains steadfast in its commitment to delivering exceptional services, fostering innovation, and contributing to the sustainable development of Ethiopia’s financial sector.

ዳሸን ባንክ በሐገር አቀፍ ደረጃ ለ6ተኛ ጊዜ በተዘጋጀው የታማኝ ግብር ከፋዮች የእውቅና እና ሽልማት መርሐ ግብር ላይ የፕላቲኒየም ደረጃ ሽልማትን ተቀብሏል፡፡

ዳሸን ባንክ በሐገር አቀፍ ደረጃ ለ6ተኛ ጊዜ በተዘጋጀው የታማኝ ግብር ከፋዮች የእውቅና እና ሽልማት መርሐ ግብር ላይ የፕላቲኒየም ደረጃ ሽልማትን ተቀብሏል፡፡