Third Season of Dashen Kefita Entrepreneurship Training Kicks Off in Hawassa

Third Season of Dashen Kefita Entrepreneurship Training Kicks Off in Hawassa

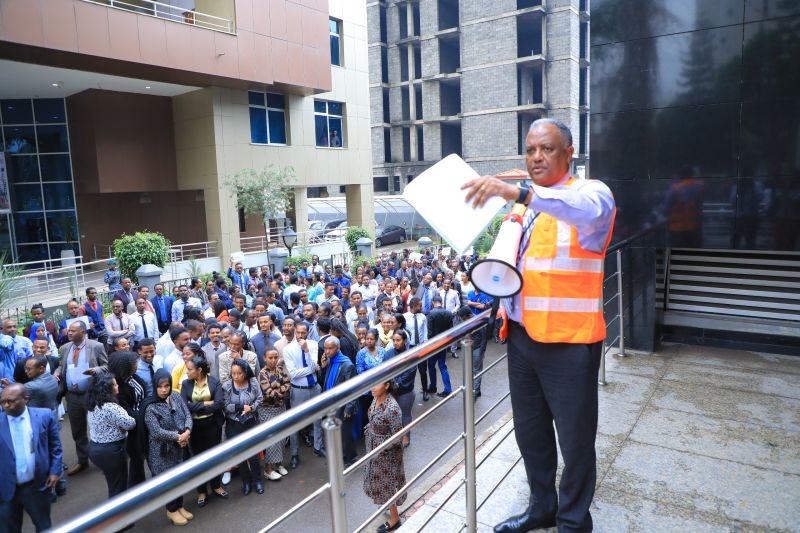

Dashen Bank proudly announces the commencement of the 3rd season of the Dashen Kefita entrepreneurship training program in Hawassa. This comprehensive training program, which precedes the entrepreneurship contest, encompasses essential topics such as business plan preparation, the fundamentals of entrepreneurship, and other relevant subjects.

Dashen Bank proudly announces the commencement of the 3rd season of the Dashen Kefita entrepreneurship training program in Hawassa. This comprehensive training program, which precedes the entrepreneurship contest, encompasses essential topics such as business plan preparation, the fundamentals of entrepreneurship, and other relevant subjects.

Ato Kefeyalewe Kebede, Head of Sidama Regional State Deputy Head of Enterprise Development and Job Creation, commended Dashen Bank for its unwavering commitment to organizing nation-wide entrepreneurship training programs. He emphasized the importance of such initiatives in fostering entrepreneurial spirit and economic growth.

Ato Endale Gebresselasie, Director of Dashen Bank’s Marketing and Branding Department, highlighted the value of the training, stating, “This program is designed to equip participants with the necessary knowledge and skills to bring their business ideas to fruition.”

Ato Petros Moges, Dashen Bank’s Hawassa District Director, reflected on the success of the previous season, noting that the winners of Dashen Kefita season 2 hailed from Hawassa. He encouraged the current participants to aspire to the achievements of their predecessors.

The Dashen Kefita training initiative is part of Dashen Bank’s corporate social responsibility efforts. Over the past seasons, the program has provided training to thousands of participants from various regions of Ethiopia. Winners of the entrepreneurship contest have received monetary prizes and financial support to help launch their businesses.

This new season will expand its reach to 9 towns across the country, continuing Dashen Bank’s mission to nurture entrepreneurial talent and drive economic development nationwide.

Dashen Bank’s staff has today planted indigenous seedlings on the hills of Entoto Mountain at the outskirts of Addis Ababa.

Dashen Bank’s staff has today planted indigenous seedlings on the hills of Entoto Mountain at the outskirts of Addis Ababa.

Dashen Bank and EagleLion System Technology have signed a Strategic Alliance Agreement today at the bank’s headquarters. Asfaw Alemu, CEO of Dashen Bank, emphasized that this partnership is crucial for achieving the goals outlined in the bank’s five-year strategic plan. The agreement will enhance digital technology options, elevate customer service, and create advanced customer experiences.

Dashen Bank and EagleLion System Technology have signed a Strategic Alliance Agreement today at the bank’s headquarters. Asfaw Alemu, CEO of Dashen Bank, emphasized that this partnership is crucial for achieving the goals outlined in the bank’s five-year strategic plan. The agreement will enhance digital technology options, elevate customer service, and create advanced customer experiences.